The country's tight money supply is trending towards a substantial return to production and consumer spending. Central bank data shows the M1+ gross money supply peaked to a new all-time high in September. The measure of money supply has seen the highest rate of growth seen in decades, all while mired in the middle of a recession and pandemic.

What Is Canada's M1+?

The M1+ is a measure of Canada's money supply. Currency outside of banks, cashable deposits at chartered banks, trust and mortgage loan companies, and credit unions. Essentially, it's anything that can be spent in Canadian dollars with little to no notice. The Bank of Canada uses this number primarily for forecasting future economic activity.

The BoC indirectly impacts monetary growth, by interest rate changes mainly. Higher rates mean money is more "expensive" leading to less borrowing and an increase in debt service costs. Reduced rates mean money is "cheap." When people borrow more, debt service costs decrease. Changes in these ratios are first observed in large financing purchases, like homes and automobiles.

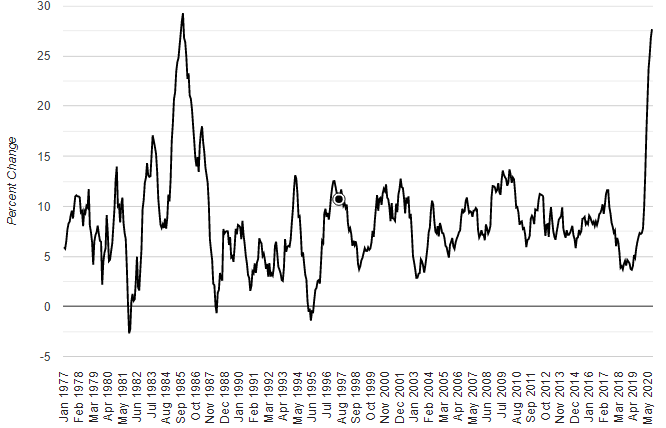

Canada's Money Supply Jumps Over 27%

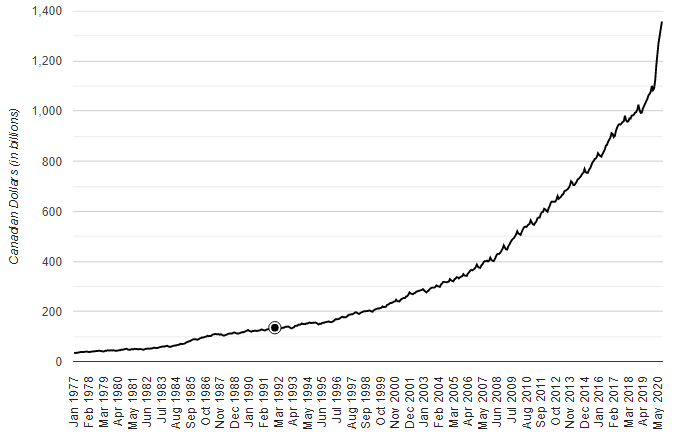

Canada's money supply is experiencing aggressive growth. The M1+ gross reached $1.36 trillion in September, a 2% increase from just a month before. The 12-month rate of growth is now 27.69% higher than last year. This level of growth is quite rare in an advanced economy.

Canada M1+ (Gross) Money Supply

The dollar value of Canada's M1+ (gross) money supply.

Canada M1+ (Gross) Money Supply Change

The 12-month change in Canada's M1+ (gross) money supply

-- Bank of Canada